Making finance finally make sense? I know how crucial it is to demystify complex concepts for clients who just want clear answers and trust. Connecting with individuals about their money requires building confidence, often starting with powerful visuals that transform confusion into comprehension.

This is precisely where creative Animated Finance Explainer examples show their strength. They offer a unique path to explain value, build rapport, and engage audiences effectively, helping translate intricate details into memorable, actionable understanding.

It’s crucial to plan ahead when it comes to high-quality video production. Discuss with our team, how you can get visual style, budget, timeline in sync.

Jai Ghosh

Video Producer at Advids

Let's talk

How can animation be used for explaining financial products?

Animation simplifies complex financial product features and workflows using visual steps and metaphors. It demonstrates product journeys like applications and highlights key benefits or terms transparently through dynamic visuals, making value propositions compelling and memorable for viewers.

How do animated videos simplify complex financial concepts?

Animated videos simplify complex finance by using visual metaphors and breaking processes into sequential steps. Storytelling makes abstract ideas relatable, while visual cues reinforce key points. Controlling pace prevents overwhelm, making intricate concepts approachable and clear.

Can animated videos help explain different investment strategies?

Animation effectively explains investment strategies by visualizing portfolio diversification and demonstrating approaches like dollar-cost averaging over time. Animated scenarios illustrate risk tolerance impacts, while visual timelines and charts clarify performance and abstract concepts.

How are animated charts and graphs used in finance videos?

Animated charts dynamically show trends and highlight specific data points, making financial data easier to interpret quickly. Motion graphics build complex graphs step-by-step, preventing overwhelm and making statistics more engaging and memorable than static numbers or tables.

How can animation be used for financial literacy programs?

Animation makes financial literacy topics like budgeting and saving approachable using characters and relatable scenarios. It clarifies abstract ideas like interest visually, engaging diverse audiences and improving retention of fundamental concepts, especially for those new to finance.

How do animated explainers make digital banking tools easier to understand?

Animated explainers guide users through digital banking workflows and demonstrate app features visually. They show the practical benefits of online tools through scenarios, clarify security features simply, and make complex processes like linking accounts appear straightforward.

How does animation help in explaining blockchain technology in fintech?

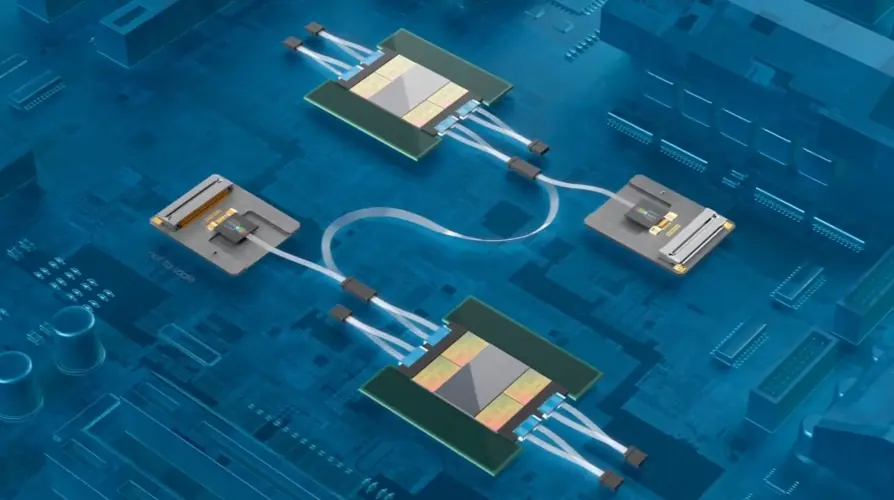

Animation clarifies blockchain by visualizing concepts like linked blocks and using metaphors like shared ledgers for decentralization. Animated sequences illustrate transaction verification and immutability, distinguishing blockchain from related concepts using clear visual elements.

How is animation used to illustrate financial concepts effectively?

Animation effectively illustrates financial concepts by using dynamic visuals and characters for abstract ideas and showing processes over time intuitively. Combining visuals, text, and voiceover reinforces understanding, and visual analogies make complex ideas immediately relatable.

In what ways does animation improve understanding of financial information?

Animation improves understanding by increasing engagement and breaking information into manageable chunks. It reduces anxiety about complex finance topics by making learning enjoyable and reinforces concepts through visual repetition, catering well to visual and auditory learners.

What animation techniques are used for financial data visualization?

Animation techniques for financial data visualization include morphing to show data transitions, highlighting specific points with motion or color, and incrementally building charts to explain progression. Zooming allows focus on details, while motion paths show relationships between data.

Choosing the right animation style for finance topics

Creating an effective Animated Finance Explainer requires more than just creative visuals; it demands careful alignment between style, content, and Strategic objectives . Selecting an animation style suitable for Complex topics versus simpler messages ensures clarity. Audience preferences also influence the visual approach, making sure the message resonates. Ultimately, blending creative expression with clear, informative design proves paramount for financial content, avoiding confusion maintaining credibility.

Strategic considerations extend beyond aesthetics to Viewer action measurability. Every video needs Clear purpose translated into specific actions viewers should take upon watching. Clear specific calls action are vital at the conclusion. Avoid generic prompts like "Learn More." Instead, use action-oriented text relevant to the video objective where viewer sits in their journey. Consider " Start Your Free Trial " "Request Demo" "Download Report" as specific actions aligning directly with goals. Measuring success involves evaluating ROI, comparing Production cost against Value generated . Metrics such as increased qualified leads shorter sales cycles reduced support tickets from better-informed users powerfully indicate effectiveness.

Making content relatable proves critical, especially for abstract financial products or services. Utilize real-world scenarios demonstrating features within relevant contexts. Showcasing how product integrates into existing workflows Solves problems specific to a user industry or daily tasks significantly increases Perceived value . Analyzing Viewer behavior provides deep insights. Heatmaps attention tracking tools reveal exactly which parts viewers watch, rewatch, or skipping. This granular data invaluable identifying confusing segments points where interest drops or tailoring an Animated banking video for retail customers. Incorporating Social proof brief flashes well-known company logos statistics about Satisfied users quickly builds credibility .

- A/B testing different video elements reveals what resonates most drives Higher conversions .

- Optimizing for different platforms requires considering viewer intent viewing environment.

- Social media videos grab attention instantly potentially understandable without sound using text overlays.

- Product page videos assume higher viewer intent can slightly longer more detailed.

Strategic choices like testing data analysis contextual relevance maximize explainer effectiveness driving tangible results .

How financial metaphors work in explainer videos

Building upon the understanding that Animated Explainer s effectively simplify complex financial ideas and resonate emotionally with viewers, creators employ further strategic techniques ensuring measurable impact and driving viewer action. Beyond the foundational aspects, guiding viewers towards desired next steps requires carefully crafted calls to action that move beyond generic suggestions, becoming explicit signals. Effectiveness hinges on demonstrating concrete value generated, proving critical for assessing return on investment.

Tracking production costs against tangible gains proves essential for showing true value delivered. Quantifying value via improved qualified lead generation provides a clear metric of success. Noting the impact on shortening the sales cycle reflects how better informed prospects move faster through consideration. Tracking lower customer support ticket volumes shows viewer comprehension regarding features and processes.

Rooting content in real-world scenarios significantly enhances viewer connection and understanding. Visualizing product integration into daily tasks or workflows makes benefits immediately clear and relatable. Analyzing how viewers interact provides invaluable data for Continuous optimization . Building trust accelerates viewer adoption, and incorporating social proof elements lends immediate credibility. Adapting videos for different platforms and viewing habits maximizes reach and impact.

- Utilizing specific action-oriented text like "Start Your Free Trial" in calls to action proves highly effective capturing desired responses.

- Analyzing how viewers interact through heatmaps and attention tracking reveals specific viewing patterns and helps identify confusing segments or points where interest drops.

- Incorporating reputable company logos or presenting statistics about satisfied users adds powerful social proof quickly building audience trust.

- Conducting A/B testing different video components such as thumbnails or the initial seconds refines the approach for peak performance while optimizing for sound-off viewing serves social media users effectively.

These combined approaches empower creators to produce powerful videos. An animated finance explainer demands attention to these details. They drive tangible business results and foster viewer confidence by making financial concepts accessible and actionable. Evaluating the success of any animated business explainer involves reviewing these key performance indicators.

Best ways explaining complex financial concepts visually

Explaining intricate financial concepts visually presents a unique challenge, demanding clarity and engagement to cut through complexity. While animation effectively captures attention, maximizing its impact requires strategic execution focused on the viewer journey and measurable outcomes. They must guide audiences deliberately toward understanding and action.

Crafting compelling calls to action is paramount. Moving beyond generic prompts, they should employ action-oriented language tailored to the video's objective and the viewer's place in their journey. For instance, an animated fintech explainer designed to showcase a new budgeting app should feature clear directives like "Download the App" or "Start Budgeting Today."

Measuring the ROI involves tracking production costs against generated value. This value can manifest as increased qualified leads, a shorter sales cycle due to better-informed prospects, or even a reduction in support tickets from users who grasped concepts from the video. Demonstrating value through real-world scenarios makes abstract financial products relatable, showing how they integrate into existing workflows or solve specific problems users face daily. An animated fintech video showcasing a payment platform, for example, could illustrate a seamless transaction process in a common business setting.

Analyzing viewer behavior provides invaluable insights. Tools offering heatmaps and attention tracking reveal precisely which parts of a video resonate or cause viewers to disengage, allowing for data-driven optimization . Incorporating social proof, such as displaying recognizable company logos that use the product or citing impressive user statistics, builds immediate trust and credibility. Optimizing for different platforms is also crucial, considering varying viewer intent and environments. Social media content needs to be instantly engaging, potentially understandable without sound, while videos on product pages can offer more detail.

- Employ action-oriented language in calls to action relevant to the viewer's stage.

- Quantify video value through metrics like lead generation and support cost reduction.

- Use real-world examples and product demonstrations to enhance relatability.

- Analyze viewer data, including heatmaps, to refine content based on engagement patterns .

By focusing on clear calls to action, Measurable results , relatable scenarios, data-driven insights, and platform optimization, explainers move beyond simple visual aids to become powerful tools for driving understanding and achieving business objectives in the financial sector.

Making emotional connections through finance animation

Connecting with viewers on a human level transforms complex financial topics into accessible, understandable concepts. This fosters trust, a critical element in the finance sector. It moves beyond simply presenting information to building a relationship, making viewers feel understood and valued. This emotional resonance encourages deeper engagement and makes financial decisions feel less daunting.

Crafting narratives around relatable human experiences allows people to see themselves in the story. Employing visual storytelling simplifies complex financial journeys that might otherwise feel overwhelming. Showcasing how services integrate seamlessly into viewers' actual lives highlights practical benefits they can immediately grasp. Focusing on solving viewer pain points through empathetic narratives builds essential trust and confidence. Building credibility also involves incorporating relevant social proof elements, like depicting positive user experiences or sharing impactful statistics visually. Simplifying daunting financial concepts eases viewer anxiety, making finance feel less like a hurdle and more like an achievable goal.

Analyzing viewer data, such as heatmaps and drop-off points, provides valuable insights into what resonates emotionally and where viewers might disengage. These insights allow for refinement of the emotional messaging. Using A/B testing on visual styles, narrative approaches, and calls to action helps optimize impact, ensuring the animation effectively connects and motivates. Refinements based on this data lead to content that truly lands with the intended audience.

- Employ compelling audio and visual design to enhance mood and establish a trustworthy atmosphere throughout the narrative.

- Guide viewers with clear, action-oriented calls aligned with their emotional state and needs after viewing the content.

- Tailor content length, tone, and visual style for different viewing platforms to match user intent and environment.

- Show, rather than just tell, the positive emotional outcomes of engaging with the financial service or product.

Consider an animated insurance explainer, for example, which offers a powerful way to visualize complex policy benefits and build confidence, transforming potential confusion into clarity and peace of mind. Ultimately, a well-crafted finance explainer video transcends mere information delivery; it builds genuine connection and encourages empowered decisions.

Techniques for simplifying finance through animation

Crafting effective animated finance content moves beyond simple explanation toward driving measurable results and deeper audience connection. Maximizing impact from a financial explainer animation requires strategic refinement, focusing viewer experience concrete outcomes. Precise calls action prove vital end productions. Instead generic prompts, use action verbs mirroring video purpose viewers journey. Start trial request demo download report prove impactful demonstrating next steps clearly.

Measuring return investment involves tracking production costs against value generated. Businesses quantify value increased qualified leads reduced sales cycle length informed prospects. Value comes reduced support tickets from users understanding features better after viewing. Using real world scenarios demonstrating features within relevant contexts makes concepts relatable believable. Showing product integrates existing workflows solves industry daily tasks increases value perceived.

Analyzing viewer behavior through heatmaps attention tracking tools reveals parts content viewers watching rewatching skipping. Granular data invaluable identifying confusing segments points where viewer interest drops allows optimization. Incorporating social proof product tour flashes well known company logos statistics satisfied users builds credibility trust quickly. Showing a financial product video embedded on a page can effectively incorporate these elements.

Conducting A B tests varying animated elements such thumbnail first seconds content CTA placement wording yields significant insights audience resonates highest conversions. Optimizing platforms requires considering viewer intent viewing environment. Videos social media grab attention instantly understandable without sound text overlays often shorter. Videos product pages assume higher intent allowing slightly longer detailed content providing deeper dive features benefits. Mastering these techniques ensures animations not just seen but drive meaningful results.

Animation techniques building trust explain finance

Trust foundational financial relationship building. Animation offers powerful means cultivate viewer confidence explaining complex products services. Firms utilize strategic visual narrative connect with audiences effectively. Clear communication builds rapport reduces uncertainty potential clients navigating financial decisions.

Effective techniques guide viewer engagement measure success. Placing calls action key converting interest into tangible steps. Specific action-oriented prompts outperform generic "learn more". They tailor viewer journey guiding toward relevant outcomes. Measuring video value demonstrates tangible return investment firms.

- Track production costs against generated value

- Assess increase qualified leads

- Note reduction sales cycle length support volume

Authenticity resonates viewers. Real-world scenarios showcase products natural usage contexts. Demonstrating features within relevant situations proves practical application value. Financial software animation effectively shows tools integrating into daily workflows. Analyzing viewer interactions provides crucial optimization data. Heatmaps attention tracking reveal engagement points drop-offs enabling content refinement.

- Incorporate social proof build instant credibility

- Feature prominent company logos user statistics

Optimizing content different viewing platforms maximizes reach impact. Viewer intent environment shape video length messaging strategy. Social feeds demand immediate attention concise messaging often without sound. Product pages allow detailed explanation assuming higher viewer interest. Insurance explainer animation on a landing page might direct viewers easily request quotes. A/B testing video elements refines performance drives higher conversions. Experimenting thumbnail content first moments CTA wording reveals optimal choices for audience.

- Test varying script versions

- Analyze results refine approach

Maximizing clarity in animated finance explanations

Creating animated finance explainers that truly resonate requires focus on practical elements driving comprehension and action. They go beyond simply presenting information, aiming to connect with viewers and guide them effectively. This involves careful planning and optimization at every stage.

To maximize impact, creators implement clear and specific calls to action. Instead of vague prompts, action-oriented text like "Start Your Free Trial" or "Download the Report" aligns with the video's purpose and viewer progression. Measuring the ROI of an animated finance explainer involves tracking production costs against generated value. This includes increases in qualified leads, reductions in sales cycle length due to better-informed prospects, or decreases in support ticket volume from users understanding features through the video.

Integrating real-world scenarios makes content relatable and believable. Demonstrating features within relevant contexts, such as showing product integration into existing workflows or solving industry-specific problems, increases perceived value. Utilizing viewer behavior analytics, including heatmaps and attention tracking, reveals exactly which parts viewers watch, rewatch, or skip. This granular data pinpoints confusing segments or moments where interest drops, enabling refinement. Incorporating social proof, such as displaying well-known company logos using the product or mentioning satisfied user statistics, builds credibility and trust swiftly. When showcasing financial products or services, particularly within a banking explainer video, utilizing authentic real-world scenarios helps viewers connect with the information. For complex topics like distributed ledgers, a blockchain animation can effectively illustrate these otherwise invisible processes, enhancing comprehension. A/B testing different video elements—from thumbnail images and initial seconds to CTA placement or wording—yields significant insights into what resonates most and drives higher conversions. Optimizing for different platforms considers viewer intent; social media videos demand instant attention and often function without sound, while a video on a product page assumes higher intent and can offer more detail. Tailoring content ensures maximum effectiveness across various viewing environments.

Avoiding financial jargon in animated explainers

Crafting financial explainers means going beyond simply translating complex terms. It involves building a clear bridge of understanding that empowers viewers to grasp value and take meaningful steps. They need precise guidance on what comes next and proof the solution fits their world.

They design calls to action that are actionable, guiding the viewer toward specific outcomes like "Start Your Free Trial" instead of vague invitations to "Learn More". Measuring video success goes beyond view counts; it means tracking quantifiable results by comparing production investment against generated value. This includes metrics such as growth in qualified leads driven by informed viewers or a shorter sales cycle.

Showcasing product features within relatable, real-world scenarios makes them tangible. Effective Financial Product Animation shows seamless integration into a user's daily tasks or existing workflows, proving practical value. Leveraging viewer analytics tools like heatmaps reveals precisely which moments resonate or cause confusion, providing crucial data for refinement. Incorporating social proof subtly builds trust by showing others benefit.

- Precise CTAs like "Request a Demo" align action with viewer readiness.

- Reduced support ticket volume indicates viewers understood features clearly.

- Analyzing viewer behavior highlights confusing segments needing rework.

- A/B testing thumbnails, intros, or CTAs fuels continuous optimization; a Crypto Explainer Video might require unique testing parameters.

This layered approach ensures explainers not only inform but also motivate, leading to better-informed decisions and demonstrable business impact.

Visualizing abstract finance concepts effectively

Crafting effective animated explanations for the finance sector goes beyond merely simplifying complex ideas. The goal becomes ensuring these visual tools not only clarify but actively engage viewers and prompt meaningful action. Teams deploying them aim to translate abstract concepts into clear, compelling narratives that resonate deeply with their target audience.

Achieving impact requires careful consideration of viewer progression. Guiding someone from understanding a concept to taking a next step is crucial. This means videos should conclude with clear, action-oriented prompts. Instead of generic calls, specific instructions tailored to the video's purpose and the viewer's likely journey prove far more effective. Teams can measure success by tracking quantifiable outcomes linked to the video's objectives.

Moreover, demonstrating genuine value through relatable examples enhances credibility. When producing a financial software demo video, showcasing real-world scenarios where the product seamlessly fits into existing workflows or solves tangible problems makes the abstract feel concrete and immediately valuable. Analyzing how viewers interact with the video provides invaluable insights into what captures their attention and where they might lose interest. This data guides refinement. Incorporating elements like social proof, such as displaying familiar client logos, can quickly build trust with potential customers. Continual refinement through testing different video components ensures the message is as potent as possible across various viewing platforms. Creating effective financial service animation demands this strategic approach, blending clarity with performance-driven design.

- Measure success by tracking metrics like increased qualified leads or reduced support inquiries.

- Utilize viewer behavior analytics to pinpoint areas for video improvement.

- Conduct A/B testing on elements like thumbnails, intros, or calls to action to optimize performance.

- Adapt video content and style specifically for platforms like social media feeds or dedicated product pages.

Crafting clear calls to action for finance videos

Crafting compelling end screens requires thoughtful design. They understand generic prompts fall flat; creators need clear calls to action. These calls utilize action-oriented text, guiding viewers toward a next logical step based on video goals and viewer interest level. Examples include "Start Your Free Trial," "Request a Demo," or "Download the Detailed Report." They tailor these precisely.

Success measurement extends far beyond view counts. Savvy creators measure their ROI by comparing production costs against value generated. This value manifests as increased qualified leads or a reduced sales cycle due to better-informed prospects. For an Insurance Explainer Video, value might be a measurable decrease in support ticket volume, indicating audience comprehension improved significantly.

To maximize effectiveness, they employ sophisticated analysis and optimization strategies. Understanding what resonates involves diving deep into audience engagement. For an Investment Explainer Video, demonstrating complex product features within relatable, real-world scenarios significantly boosts perceived value and viewer retention, insights often gained through data.

- Analyzing viewer behavior through heatmaps and attention-tracking pinpoints confusing segments or moments interest drops, enabling precise edits.

- Incorporating social proof like client logos or user statistics rapidly builds trust and credibility with hesitant viewers.

- They use A/B testing for various video elements – thumbnails, initial seconds, CTA wording, or placement – revealing data-backed paths to higher conversions.

- Optimizing for platforms means considering viewer intent and viewing environment; social feeds need immediate grabs, while product pages allow deeper dives, potentially without sound.

By meticulously crafting calls, diligently measuring impact, and continuously optimizing based on audience data, creators ensure their finance explainers deliver powerful, measurable results.

Author & Editor Bio

A video producer with a passion for creating compelling video narratives, Jai Ghosh brings a wealth of experience to his role. His background in Digital Journalism and over 11 years of freelance media consulting inform his approach to video production. For the past 7 years, he has been a vital part of the Advids team, honing his expertise in video content planning, creation, and strategy.

His collaborative approach ensures that he works closely with clients, from startups to enterprises, to understand their communication goals and deliver impactful video solutions. He thrives on transforming ideas into engaging videos, whether it's a product demo, an educational explainer, or a brand story.

An avid reader of modern marketing literature, he keeps his knowledge current. Among his favorite reads from 2024 are "Balls Out Marketing" by Peter Roesler, "Give to Grow" by Mo Bunnell and "For the Culture" by Marcus Collins. His results-driven approach ensures that video content resonates with audiences and helps businesses flourish.